May 2023 Issue

Business Plus+ Newsletter

Index

Major Grants That Are Continuing

High Research and Development Expenditure

Some Government Grants Closed

In the Federal Government’s supporting documents for the Federal Budget there were notes to indicate that the following grants were closed on 8 May 2023:

In the Federal Government’s supporting documents for the Federal Budget there were notes to indicate that the following grants were closed on 8 May 2023:

- Accelerating Commercialisation

- Business Growth Grant

- Innovation Connection

The notes also indicated that the Entrepreneurs Connect Program which was the “umbrella organisation” for each of these grants also ceased activities on budget night.

The Government has indicated that any business that had received grant approval for any of these grants would continue to receive payments approved under those grants.

The Government’s website is indicating that the Accelerating Commercialisation Grant will be included within the new Industry Growth Program and that the guidelines for the new grant to be delivered by the Industry Growth Program will be announced “later in 2023”.

We will keep you updated on developments on the new grants to be announced “later in 2023”.

Major Grants That Are Continuing

There have been no changes announced relating to the Research and Development Tax Incentive Scheme or the Export Market Development Grant.

There have been no changes announced relating to the Research and Development Tax Incentive Scheme or the Export Market Development Grant.

The Research and Development Tax Incentive is available to companies who have expended more than $20,000 in a financial year on legitimate research and development activities irrespective of the number of projects that were undertaken.

For companies with turnovers under $20 million the Research and Development Tax Incentive is calculated at the applicable company tax rate – currently 25% plus the Research and Development Premium of 18.5% meaning that the Research and Development Tax Incentive is 43.5% of the legitimate research and development expenditure.

Companies with turnovers under $20 million, if the company is trading at a loss, the company can include an application in its Income Tax Return for the value of the Research and Development Tax Incentive to be paid direct to the company, subject to the amount of the research and development tax incentive being less than the accumulated tax losses within the company. This is a tremendous benefit for small companies who are undertaking research and development activities.

Companies with turnovers under $20 million, if the company is trading at a loss, the company can include an application in its Income Tax Return for the value of the Research and Development Tax Incentive to be paid direct to the company, subject to the amount of the research and development tax incentive being less than the accumulated tax losses within the company. This is a tremendous benefit for small companies who are undertaking research and development activities.

The Export Market Development Grant is available for any type of business with turnover for the financial year under $20 million. The business submits an application detailing the promotional activities that it would like to undertake to promote products or services that the business is exporting or planning to export. Applications for the Export Market Development Grant in 2023/24 have closed.

If you are interested in submitting an application for a grant in 2024/25 you will need to assemble your data for the application which we anticipate will be required to be lodged around February 2024.

If you have any questions on these continuing grants or grants in general, please do not hesitate to discuss these with your accountant or contact Peter Towers on 07 4724 1118 or 1800 232 088.

High Research and Development Expenditure

The Research and Development Tax Incentive Scheme is estimated by the Department of Industry, Science and Resources to reach its highest total value this financial year.

The overall estimated investment through the Research and Development Tax Incentive (RDTI) is estimated to be more than $3.2 billion in the financial year 2022 – 23 about $200 million more than was estimated in 2021/22.

“There are two Research and Development tax offsets available under this scheme, a refundable offset for companies with annual turnovers below $20 million, and a non-refundable offset for companies with turnovers above $20 million.”

The report indicated that “most of the scheme’s investment will come through the refundable offset at an estimated value of $2.54 billion with the remaining $620 million through the non-refundable offset.”

This is great news for SMEs and gives an indication of the significant amount of money being invested by the small business community in research and development activities.

If you would like to discuss a research and development strategy for your company, please do not hesitate to contact your accountant or contact Peter Towers on 07 4724 1118 or 1800 232 088.

Driving Business Growth

A key challenge facing all business operators is that all businesses, no matter what sector, need to keep moving, to adjust and adapt to changing market conditions.

If such movement doesn’t happen in the right way and time – businesses can be negatively impacted.

If such movement doesn’t happen in the right way and time – businesses can be negatively impacted.

This highlights the need especially in 2023 to drive business growth because of the challenges that are emerging:

- High interest rates

- High inflation

- Shortage of willing workers even though the unemployment percentage has risen to 3.7%

- What trends are likely to affect your business operations and your growth aspirations?

- Could you charge a premium for some of your products or services?

- Have you considered offering a bundle of products or services to bolster sales?

- Have you introduced a “loyalty program”? Do you think that would assist your business operations?

- Do you analyse your competitors – what they are doing – new products or services – have you developed a strategy to compete with them?

- If you are charging your team to clients/patients for work performance have you analysed the charge out rates you are charging?

The items to check are:

- Productivity of individual team members

- How does the team member productivity compare to your original charge out rate calculations?

- Overhead expenses within the business – how does the total overhead expenses that you are incurring compare to the estimate utilised in the charge out rate calculations?

- If you are purchasing goods on behalf of your clients – how does the revenue generated from the mark-up on those goods compare to the mark-up that you utilised in the charge out rate calculations?

- This type of analysis might indicate that you need to review the charge out rates if you are going to achieve your annual targeted profit.

If you would like to discuss strategies that could be implemented for “Driving Business Growth” in your business, please do not hesitate to discuss this with your accountant or contact Peter Towers on 07 4724 1118 or 1800 232 088.

Board of Advice

Managing a business is a lonely affair and many business operators have found that they can benefit from forming a Board of Advice which would meet throughout the year to give advice to the Directors on various issues.

It should be noted that the Advisory Board function is to only give advice and that the final decision on every matter needs to be made by the Directors/Owner.

It should be noted that the Advisory Board function is to only give advice and that the final decision on every matter needs to be made by the Directors/Owner.

Board of Advice Members are normally drawn from variable industry/professional backgrounds so that Directors are receiving advice from different viewpoints be it experienced business operator, CEO experience, accounting, legal, medical, marketing, sales or engineering experience.

Being aware of corporate governance issues is essential for business operators and can include:

- An awareness of regulatory requirements: keeping up-to-date with the business’ legal and regulatory requirements ensures that the business remains compliant and avoids potential fines and other legal consequences and embarrassment.

- Risk management: businesses need to adopt sustainable and responsible practices to mitigate financial, reputational and legal risks by addressing potential issues before they become problems.

- Consumer demand: SMEs also need an awareness of consumer preferences as many people are becoming more conscious of the environmental, social and ethical impacts of their purchases and the businesses that they are dealing with.

To be effective Advisory Boards normally meet around 10 times per annum and discuss a range of issues including:

- Business Plan

- Budgets, Cash Flow Forecast and Projected Balance Sheet

- Financial Performance – Profit and Loss Accounts for each business unit

- Actual v Budget comparisons

- Cash Flow / Working Capital analysis

- Balance Sheet

- Key Performance Indicators and Ratio Analysis

- Marketing

- Sales

- Leadership Team Development

- Team Training

- Succession Planning

- Competitor Analysis

- Uptake of Technology for the Business

- Considers issues of concern raised by the Directors or Owner

If you would like to discuss the formation of a Board of Advice for your business, please do not hesitate to contact your accountant or contact Peter Towers on 07 4724 1118 or 1800 232 088.

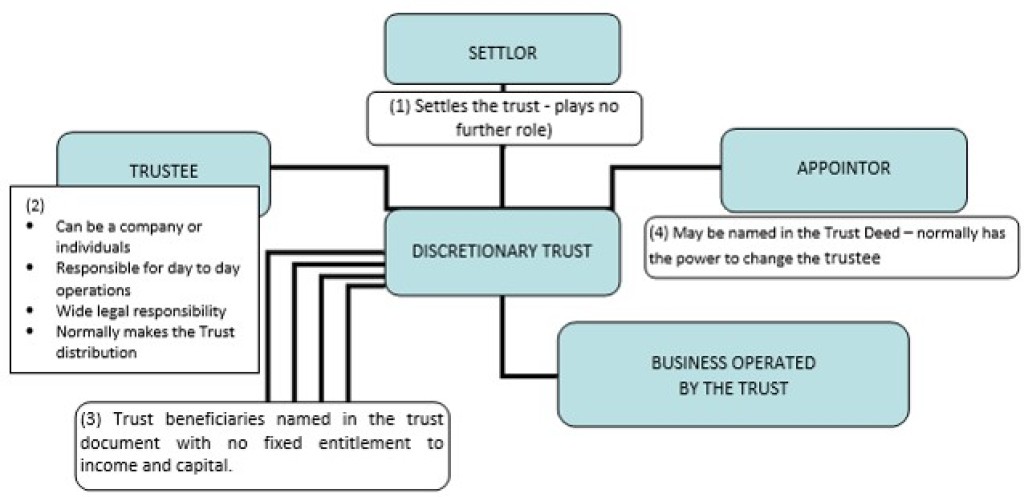

Discretionary Trust

A Discretionary Trust is a very common vehicle for use by families, for business operation. Every Discretionary Trust needs the following:

- Settlor: the person who establishes the Trust and signs the Trust documents. The Settlor should never be a Beneficiary under the Trust.

- Trustee: can be a company or, at least, two individuals. The Trustees are responsible for all day-today activities of the trust.

- Trust Deed: sets out:

- the objects of the Trust;

- what the Trust can do;

- investment powers;

- borrowing powers;

- the names of the settlor, Beneficiaries, Trustee and Appointor.

- Beneficiaries: Beneficiaries can be divided into a number of groups:

- Primary Beneficiaries

- Secondary Beneficiaries

- Tertiary beneficiaries

A Discretionary Trust, through the Trustees, can conduct a wide range of business activities.

The Discretionary Trust has to prepare an Income Tax Return for the activities of the Trust, and show the distribution of the taxable income of the Trust to the Beneficiaries. In a Discretionary Trust, the Trustee utilises its own discretion as to which of the Beneficiaries will receive the income of a Trust. The Beneficiaries have to include their share of distribution from the Discretionary Trust in their own Income Tax Return, and income tax on their total taxable income.

In normal circumstances, the Discretionary Trust does not pay income tax. However, it may have to pay income tax if the Trustee has not distributed the taxable income. Tax is paid at a penalty rate.

The flowchart of a Discretionary Trust is as follows: