June 2023 Issue

Business Plus+ Newsletter

Index

Taxable Payments Annual Report

Early Stage Innovation Company Report

Did You Undertake Research and Development Activities During 2022/23?

Business Entities – Unit Trusts

Surviving in Difficult Times

There is no doubt that we live in challenging times – high inflation – high interest rates – speculation of a recession.

This all amounts to difficult times for SMEs.

This all amounts to difficult times for SMEs.

We can assist you with a range of services to improve your business performance.

Some of the services which can be provided have been proven to assist other businesses:

- Identifying strategies for 2023/24 in a “strategic review”:

- Preparation of a Business Plan or an updated Business Plan

- Preparation of Budgets for each individual business unit within your business

- If you operate as a Tradie or manufacturing business we could prepare a charge out rate calculation report to ensure that the combination of realistic productivity hours for each of your team members, business overhead costs, mark-up on external purchases made for clients, will be sufficient to generate the targeted profit you wish to make.

- For professional services firms we can prepare a similar charge out rate calculation.

- For retail/wholesale businesses we can prepare a report to evaluate the quantity of products that you plan to purchase and the mark-up rates applicable to those stock categories together with the expenses of operating the business to determine whether the projected “sales mix” will enable your business to generate the targeted profit you wish to make.

A benchmarking analysis of your business compared to other similar businesses will give some insights into changes or improvements that you may be able to make.

A benchmarking analysis of your business compared to other similar businesses will give some insights into changes or improvements that you may be able to make.- A Cash Flow Forecast is a very important document because this will identify if your expansion, investment in Research and Development Patent Protection costs etc. will affect the cash that you have available in the business which could mean that we would recommend evaluating whether you should attempt to raise capital direct from the public as a “Crowd Sourced Funding Equity Raising Company” or under section 708 of the Corporations Act.

- The projected Balance Sheets which are prepared as part of the Predictive Accounting Reports will enable you to review what your business’ financial position could look like in 3 – 5 years’ time.

There are a number of ongoing business activities that can be implemented to assist businesses to perform better including:

- Weekly Performance Report – analysing trends, Key Performance Indicators and the profit or loss generated from each activity’s performance in the previous week. This is important information that many larger companies obtain each week that can also be very powerful information for SMEs to have.

- Monthly Financial Accounts prepared for each business unit that the business operates are an important component of the critical information that the Leadership Team needs to assist them to make decisions in difficult trading conditions.

- The monthly Financial Accounts should include Key Performance Indicators and a comparison to budget so that a complete picture of what is happening within an individual business unit for the month is available. The prompt access of this type of financial report gives your Leadership Team access to real information that can assist in the day-to-day management of the business.

- Monthly Business Review Meeting – this is an opportunity for the Leadership Team to meet with your accounting advisor for a detailed review of actual performance including discussions on items that are at variance to the assumptions that were made in the Budgets. In this way a review can be made of variances to see whether remedial action needs to be taken to prevent similar variations occurring in the future.

This system of twelve (12) monthly evaluations of financial performance have been proven by many SME companies and most larger companies as the financial strategy that is important to ensure the financial viability of a business. It is not sound management to be relying on an annual set of Financial Accounts and Income Tax Return to monitor financial performance of the business.

This system of twelve (12) monthly evaluations of financial performance have been proven by many SME companies and most larger companies as the financial strategy that is important to ensure the financial viability of a business. It is not sound management to be relying on an annual set of Financial Accounts and Income Tax Return to monitor financial performance of the business.- Debtors is a very important area for leadership supervision primarily relating to debtor’s days outstanding and also whether appropriate protection has been taken for a new customer on the Personal Property Securities Register (PPSR).

- The components of working capital need to be monitored at least monthly relating to the investment in debtors, stock, work in progress, bank account and the level of creditors and external commitments including the Australian Taxation Office.

- If your company is undertaking Research and Development projects it is important that a monthly review is conducted to ensure that the research activities are being appropriately documented so that there will be no problems with the documentation to be submitted to AusIndustry and the Australian Taxation Office as the supporting evidence for the company’s claim for the Research and Development Tax Rebate.

This summary of strategies relating to “Surviving in Difficult Times” is of a general nature. We are able to refine this approach to conduct a specific evaluation of strategies for your business to assist your business to prosper during 2023/24. If you would like to have a discussion with us relative to the approach that we would take to conducting a business review of your business please do not hesitate to contact us.

Taxable Payments Annual Report

A reminder that if your business operates in an industry that is required to lodge a “Reportable Payment Report” you are required to lodge that report by 28 August 2023.

The industries that this requirement applies to are:

The industries that this requirement applies to are:

- Building and construction industries

- Courier services

- Cleaning services

- Information technology

- Road freight

- Security, investigation and surveillance services

The report needs to include details of payments made to contractors for services during 2022/23.

If less than 10% of your business income relates to any of the industries listed you do not need to lodge a Taxable Payments Annual Report.

If you have any questions relative to this report or need assistance in its preparation, please do not hesitate to contact the person in your accountant’s organisation that you normally deal with.

Early Stage Innovation Company Report

If your company has issued shares to investors who invested on the basis of the company’s representations that the company qualified as an Early Stage Innovation Company, the Directors of the company are required to ensure that an “Early Stage Innovation Company Report” is lodged with the Australian Taxation Office by 31 July 2023.

If your company has issued shares to investors who invested on the basis of the company’s representations that the company qualified as an Early Stage Innovation Company, the Directors of the company are required to ensure that an “Early Stage Innovation Company Report” is lodged with the Australian Taxation Office by 31 July 2023.

The report includes details of shares issued during the year that the company believes that when the shares were issued the company qualified as being an Early Stage Innovation Company under the “Gateway Test” or the company has received a letter from the Australian Taxation Office in response to the application made by the company under the “Principles Test”, that the Australian Taxation Office has accepted that the company qualifies as an Early Stage Innovation Company.

The Australian Taxation Office requires this information so that they can monitor claims being made by investors relative to the taxation offset that qualifying investors in an Early Stage Innovation Company can be entitled to and exemptions from Capital Gains Tax on those shares if the original holder relative to the obtaining of the “Early Stage Innovation Company Status” retains ownership of those shares for longer than twelve (12) months and less than ten (10) years.

Did You Undertake Research and Development Activities During 2022/23?

To claim the taxation offset for Research and Development expenditure in 2022/23 expenditure must have been incurred by a company totalling at least $20,000 in the financial year irrespective of the number of projects undertaken and detailed records maintained of the individual research projects, “prior art searches”, the hypothesis/hypotheses identified for each project, results of the experiments, costs of the activities undertaken and the general information required under the legislation.

If you have undertaken Research and Development in 2022/23 and you have maintained appropriate records and if you have traded at a loss you might be interested in having your financial affairs finalised as soon as possible so that the Research and Development Registration Form can be completed and lodged with AusIndustry as soon as possible after 30 June 2023.

When AusIndustry has reviewed the registration form and if they are satisfied with the information submitted they will then issue a reference number to be included on your company’s income tax return and you can then elect that if your company is trading at a loss, that the Australian Taxation Office will refund the Research and Development Tax Offset Amount (calculated at 43.5% of the legitimate Research and Development expenditure) within thirty (30) days of the tax return being lodged, so long as the Research and Development Tax Offset Amount is less than the tax losses for the company.

If you would like to avail yourself of the opportunity to finalise the information required for the registration form and then the prompt lodgement of the company’s income tax return so as to avail yourself of the refund from the Australian Taxation Office, please contact your accountant as soon as possible so that they can assist you with the registration form required to be lodged with Ausindustry. When the reference number is received they will then be able to complete the tax return for the company and lodge the company’s return with the Australian Taxation Office. This should ensure that you receive the taxation refund promptly.

If you would like to avail yourself of the opportunity to finalise the information required for the registration form and then the prompt lodgement of the company’s income tax return so as to avail yourself of the refund from the Australian Taxation Office, please contact your accountant as soon as possible so that they can assist you with the registration form required to be lodged with Ausindustry. When the reference number is received they will then be able to complete the tax return for the company and lodge the company’s return with the Australian Taxation Office. This should ensure that you receive the taxation refund promptly.

If you elect to claim the tax refund for Research and Development this will have the effect of reducing the carry forward tax losses within your company.

If you have been undertaking Research and Development activities within your company and whilst you have kept records of all of these activities including “prior art searches”, you have not previously consulted your accountant about the Research and Development activities, please contact them as soon as possible so that they can review your records and advise whether you will be able to claim a Research and Development Tax Rebate for 2022/23.

A reminder, if you don’t wish to lodge your tax return early, the Research and Development registration must be lodged with AusIndustry no later than 30 April 2024 or the date of lodgement of the company’s income tax return whichever is the earlier.

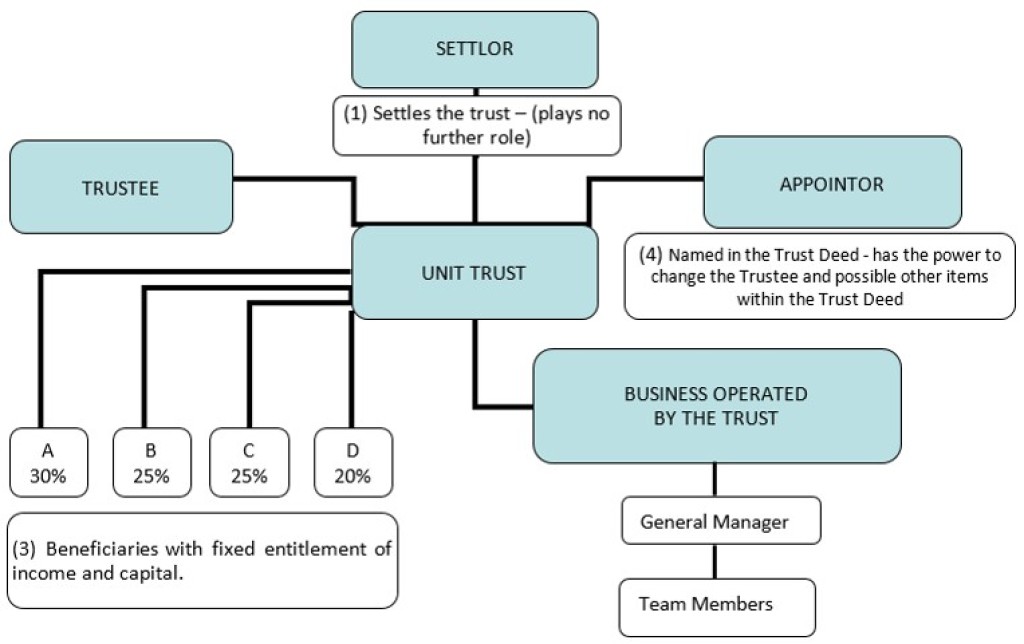

Business Entities – Unit Trusts

A ‘Unit Trust’ is different to a discretionary trust (refer Issue 225 – May 2023). Many small business operators use Unit Trusts for their business operations. In a Unit Trust, a Beneficiary has a fixed interest with a designated number of units similar to a partnership. The Beneficiary is called a ‘unit holder’, and is entitled to a distribution of income, in accordance with the percentage of units held in the Unit Trust. It is not unusual in a Unit Trust for there to have been a payment made for units allocated. A Unit Trust is normally used when there is more than one family or group of people involved in a business operation.

The Unit Trust needs a trustee. A trustee can be a company or, at least, two individuals. The trustee is responsible for all day to day activities of the trust. The activities of the trust are governed by the Trust Deed. This records the name, address and number of units owned by each unit holder.

A Unit Trust can operate virtually any type of business. In normal circumstances the Unit Trust does not pay income tax. The trustee must ensure there has been a distribution of the taxable income to the unit holders, in accordance with the percentage they hold in the Unit Trust. If the trustee does not make a distribution, then the trust has to pay income tax at the penalty rate of 46.5%.

There are special laws relating to Unit Trust losses and bad debts incurred by a Unit Trust. If you would like details, please contact us.

An example of a Unit Trust flow chart:

If you have any questions on any aspect of the operations of a Unit Trust, please do not hesitate to contact us.

If you have any questions on any aspect of the operations of a Unit Trust, please do not hesitate to contact us.